How to Create a 50/30/20 Budget: That Works for You

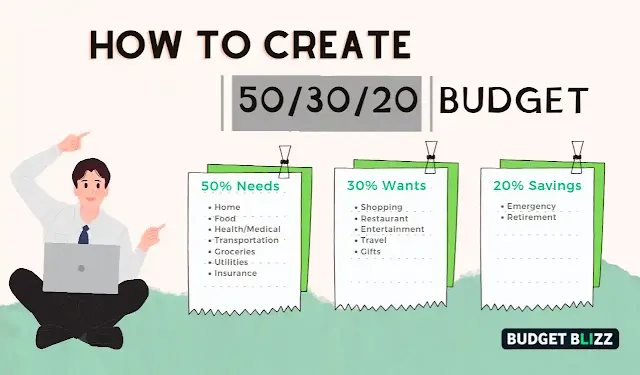

A50/30/20 budget is a simple and effective way to allocate your income among three main categories needs, wants, and savings.

This budgeting system gained fame from Elizabeth Warren, a Harvard professor and U.S. Senator, who wrote about it in her book All Your Worth The Ultimate Lifetime Money Plan.

The idea is to spend 50 of your after-tax income on your requirements, 30 on your wants, and 20 on your savings. This way, you can balance your current and unborn financial requirements, while also enjoying your life and having some fun.

But how do you create a50/30/20 budget that works for you? Then are some ways to follow:

Step 1: Calculate your after-tax income

Your after-tax income is the amount of money you take home after abating taxes, social security, and other mandatory deductions from your paycheck. This is the amount you have to work with for your budget.

To calculate your after-tax income, you can use a free online calculator, example this calculator. Alternatively, you can look at your pay remainders or bank statements and add up your net income for the month.

Still, similar to tips, and bonuses, if you have any other sources of income.

Step 2: Identify your needs

Your needs are the essential expenses that you need to pay for your survival and well-being. These include:

- Housing (rent or mortgage, property taxes, insurance, conservation, etc.)

- Serviceability (electricity, water, gas, internet, phone, etc.)

- Food (groceries, dining out, etc.)

- Transportation (motor vehicle payment, gas, insurance, maintenance, public transit, etc.)

- Health care (insurance, co-pays, prescriptions, etc.)

- Child care or elder care (if applicable) Debt payments (minimal payments on credit cards, student loans, particular loans, etc.)

To identify your needs, you can review your bank statements, credit card statements, bills, and receipts for the once many months and add up your average spending on these orders.

Step 3: Identify your wants

Your wants are the optional costs that you spend on your life and enjoyment. These include:

- Entertainment (movies, musicals, games, hobbies, etc.)

- Travel (flights, hotels, motor vehicle rentals, etc.)

- Shopping (clothes, shoes, accessories, etc.)

- Personal care (haircuts, manicures, massages, etc.)

- Gifts and donations (charity, birthdays, marriages, etc.)

- Subscriptions and memberships (Netflix, Spotify, Gym, etc.)

To identify your wants, you can use the same system as for your requirements and add up your average spending on these categories.

Step 4: Identify your savings

Your savings are the money that you set away for your future goals and emergencies. These include

- Emergency fund (3 to 6 months of living costs in a high-yield savings account)

- Retirement savings (401(k), IRA, Roth IRA, etc.)

- Education savings (529 plan), ESA, etc.)

- Other savings (down payment, holiday, marriage, etc.)

To identify your savings, you can look at your current savings accounts, investment accounts, and retirement accounts and see how important you're contributing to them every month.

Read also: Top 7 Financial Planning Mistakes & How to Avoid Them

Step 5: Adjust your spending

Now that you have calculated your after-tax income and linked your needs, wants, and savings, you can compare them to the50/30/20 rule and see how you're doing.

To do this, you can divide each category by your after-tax income and multiply by 100 to get the percentage. For illustration, if your after-tax income is 4,000 and your needs are $ 2,000, also your needs percentage is 50 ($2,000/$ 4,000 x 100).

Immaculately, you want your needs to be 50 or lower, your wants to be 30 or lower, and your savings to be 20 or further. Still, this isn't a one-size-fits-formula, and you can adjust it according to your particular situation and preferences.

For example, if you live in a high-cost area, you might have to spend further than 50 on your needs. In that case, you can try to reduce your wants or increase your income to balance your budget.

On the other hand, if you have a low income, you might have to spend less than 30 on your wants or less than 20 on your savings. In that case, you can try to find ways to save money on your needs or increase your income to boost your budget.

The key is to find a balance that works for you and helps you achieve your financial goals.

Step 6: Track your spending and review your budget

Creating a50/30/20 budget isn't a one-time thing. It's a nonstop process that requires you to track your spending and review your budget regularly.

To track your spending, you can use a free app like Mint or YNAB or a simple Excel budgeting. This will help you see where your money is going and how it aligns with your budget.

To review your budget, you can do it yearly, daily, or annually. This will help you see how your income and costs change over time and how you can adjust your budget consequently.

You can also use this opportunity to celebrate your progress and reward yourself for sticking to your budget.

Conclusion

A50/30/20 budget is a simple and effective way to manage your money and save for your goals. It can help you balance your needs, wants, and savings, while also enjoying your life and having some fun.

Still, it isn't a rigid rule that you have to follow exactly. You can customize it to fit your particular situation and preferences, and acclimate it as your circumstances change.

The most important thing is to be harmonious and realistic with your budget and to track your spending and review your budget regularly.

By following these ways, you can make a50/30/20 budget that works for you and helps you achieve your Financial dreams.