How to Build an Emergency Fund: Fast & Effectively

Are you prepared for a financial emergency? Or are you among the many who find themselves counting on credit cards or loans when unexpected costs arise?

Let's dive into the topic and discover how you can start making your emergency fund today.

Quick Financial Planning Tips for Building an Emergency Fund

In this section, we will explore practical strategies and hacks to help you quickly make your emergency fund. By following these tips, you can save money for unanticipated costs, accelerate the growth of your emergency fund, and ensure financial stability in times of need.

Save Money for Unexpected Expenses

One crucial way to build an emergency fund is to save money for unexpected costs. By creating a budget and cutting unnecessary costs, you can free up more funds to allocate towards your emergency fund. Consider reviewing your yearly bills and subscriptions to identify areas where you can reduce spending and turn those savings toward your emergency fund.

Accelerate Emergency Fund Growth

There are several rapid fund-building strategies to help you grow your emergency fund fast. One effective approach is setting up automatic transfers from your checking account to a devoted emergency savings account. By automating the process, you ensure consistent benefactions and accelerate your emergency fund growth over time.

Explore Emergency Fund Building Hacks

Building your emergency fund can be easier with some smart savings hacks. Consider applying these strategies:

- Create a visual reminder: Put a picture or a note in your wallet or on your fridge to remind you of your plan.

- Set up a savings challenge: Challenge yourself to save a certain percentage or dollar amount each week or month.

- Use windfalls: Put unanticipated bonuses, tax refunds, or other windfalls directly into your emergency fund.

- Shop smarter: Use coupons, comparison shop, and opt for general brands to save money on everyday purchases.

Emergency Savings Strategies

Lastly, let's discover some effective emergency savings strategies:

- Establish an achievable savings plan: Determine how important you want to save for emergencies, whether it's three to six months' worth of costs or a specific dollar amount.

- Make a separate emergency savings account: Keeping your emergency fund separate from your daily spending account ensures that you will not dip into it for non-emergency costs.

- Regularly review and adjust your savings plan: Revisit your savings plan periodically and make adjustments as needed to align with changes in your financial situation.

- Consider indispensable income sources: Explore fresh ways to make income, similar to freelancing or part-time work, to boost your emergency fund quickly.

| Quick Financial Planning Tips | Benefits |

|---|---|

| Save money for unexpected expenses | Prepare for unexpected financial burdens |

| Accelerate emergency fund growth | Build up your emergency fund rapidly |

| Explore emergency fund-building hacks | Discover innovative strategies to save money |

| Emergency savings strategies | Develop effective savings plans for emergencies |

Creating an Emergency Fund Rapidly for Financial Security

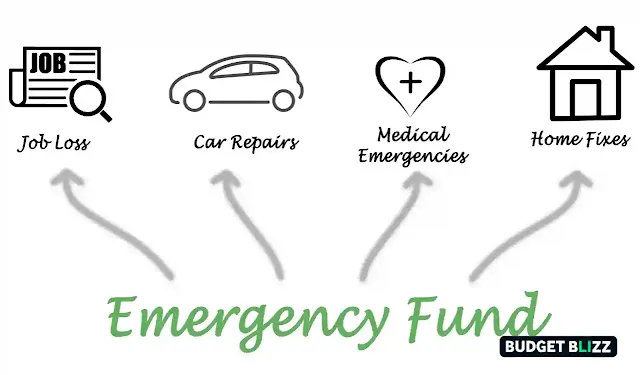

|

| Some examples of emergencies |

In this section, we'll focus on steps you can take to quickly build your emergency fund and establish financial security. Having an emergency fund is essential for providing financial stability and peace of mind during uncertain times. You can quickly build a solid emergency fund by following these quick financial planning tips and applying effective strategies to save money for emergencies.

1. Automate Your Savings

One of the best ways to accumulate funds for emergencies is to automate your savings. Set up an automatic transfer from your paycheck directly into a separate savings account designated for your emergency fund. This ensures that a portion of your income is constantly put aside for emergencies without you needing to consciously think about it.

2. Reduce Expenses and Increase Savings

Take a close look at your routine expenses and identify areas where you can cut back. Consider reducing optional spending, similar to entertainment or dining out, and redirect those savings towards your emergency fund. also, evaluate your utility bills, insurance premiums, and subscriptions to see if there are opportunities for savings.

Read also: Beginner’s Guide to Smart Investing: Top Tips for Success

3. Set Realistic Goals

Establishing Attainable saving plans is pivotal for building an emergency fund rapidly. Start by determining how much you would like to have in your emergency fund, similar to three to six months' worth of living costs. Break down this larger plan into lower, routine contributions, making it more attainable and motivating.

4. Look for Ways to Increase Income

Supplement your regular income by exploring fresh sources of earnings. This could involve taking on a part-time job, freelancing, or starting a side business. The redundant income generated can be directly allocated towards building your emergency fund fast.

5. Prioritize Your Emergency Fund

When allocating your monthly budget, make your emergency fund a top priority. Treat it as a necessary expense that must be fulfilled before allocating money to other categories. By making it a priority, you ensure that your emergency fund receives harmonious contributions and grows rapidly.

By applying these strategies, you can take a significant way towards creating an emergency fund fast and building an emergency fund rapidly. It's never too late to start prioritizing your financial security and being prepared for unanticipated expenses.

At the end of the article, prioritizing financial preparedness by creating an emergency fund is crucial for long-term financial security. By building a savings account and accelerating your emergency savings, you can protect yourself against unexpected expenses and financial emergencies.

Having an emergency fund provides a safety net that allows you to handle unlooked-for circumstances without risking your financial stability. It gives you peace of mind knowing that you have the resources to navigate through turbulent times and avoid falling into debt.

Conclusion

To accelerate your emergency savings, consider applying strategies similar to setting aside a percentage of your income each month, cutting back on unnecessary expenses, and exploring opportunities to boost your income. By consistently saving and making sound financial decisions, you can gradually build a substantial emergency fund.

Remember, building an emergency fund requires discipline and commitment. It may take time, but the effort is well worth it. Following these tips and keeping financial preparedness at the forefront of your financial journey can establish a solid foundation for a secure future.